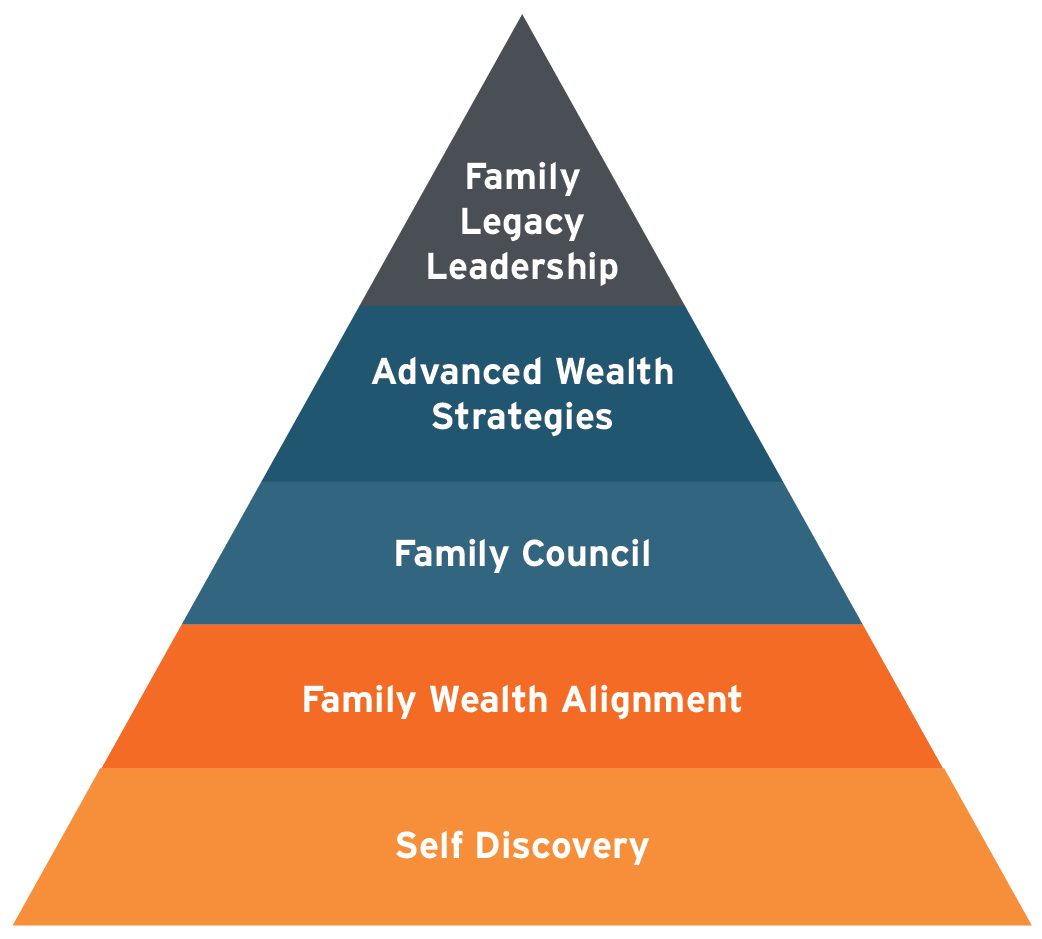

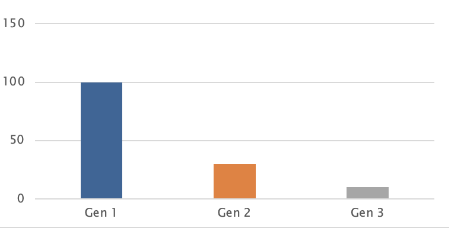

Planning your legacy is something many people fail to accomplish as they are too busy creating their legacy. In fact, only ten percent of family wealth lasts beyond the third generation. Our Family Wealth Stewardship process allows clients to step back and see the big picture, focusing on their estate planning and how to help minimize estate taxes while maintaining family harmony, and ultimately, planning and creating a legacy for multiple generations.

90% of family assets are spent or lost by the 3rd generation

More than 90 percent of families with legacy wealth follow a path that leads to the eventual loss of their assets and the damage to their family harmony.* Imagine if you were able to pass along, not only your material wealth, but also your values and wealth-building skills. And, imagine what contributions to family and community might three generations, empowered with those skills and attributes, be able to make?

Sullivan, M. (2013, March 8). Lost Inheritance. The Wall Street Journal. https://www.wsj.com/articles/SB10001424127887324662404578334663271139552

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Securities offered through Hightower Securities, LLC, Member FINRA/SIPC, Hightower Advisors, LLC is a SEC registered investment adviser. brokercheck.finra.org

©2026 Hightower Advisors. All Rights Reserved.