Investment Strategy

Your Concerns

Do you have confidence your portfolio has the potential to achieve your goals?

Are your returns competitive? Is your portfolio positioned to reflect the current economic climate?

Are your investment advisor’s interests aligned with yours?

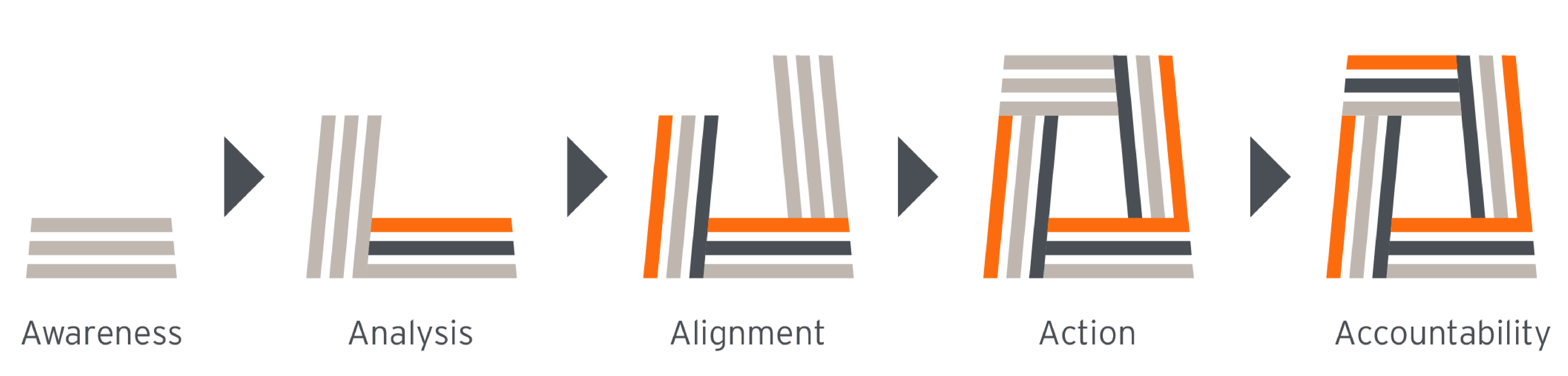

Our portfolio management process aims to provide you with the answers to these questions.

We use a portfolio management process that is:

Responsive to your personal risk sensitivity

Built to pursue your unique goals over the long-term

Responsive to the current economy

Disciplined

Our Portfolio Management Helps Create:

Strategic Strength

Our process starts with a traditional strategic asset allocation that for the long-term should effectively meet your risk, cash flow and liquidity needs. This portfolio design helps to ensure transparency in pursuing your desired results.

Tactical Flexibility

We then deploy a deeper, economically-sensitive tactical rebalancing. Our analytic tools are designed to help our team enhance results during volatile trends to help optimize returns and help minimize the risk. We aim to take advantage of market dislocation by over- and underinvesting certain asset classes based on market conclusions.

Personal Relevance

We plan for, and react to, market changes in coordination with your defined needs. We use an open-selection process, encompassing a wide-array of investment vehicles based on your goals and objectives. Since we have no incentive other than your success, our independence allows us to explore all opportunities.

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Securities offered through Hightower Securities, LLC, Member FINRA/SIPC, Hightower Advisors, LLC is a SEC registered investment adviser. brokercheck.finra.org

©2026 Hightower Advisors. All Rights Reserved.